Thanks for joining us for our February Market Update! Let’s start by reviewing 2021’s statistics.

Tom Ruff with the Information Market summed up 2021 and the challenges we face in 2022 beautifully. He wrote:

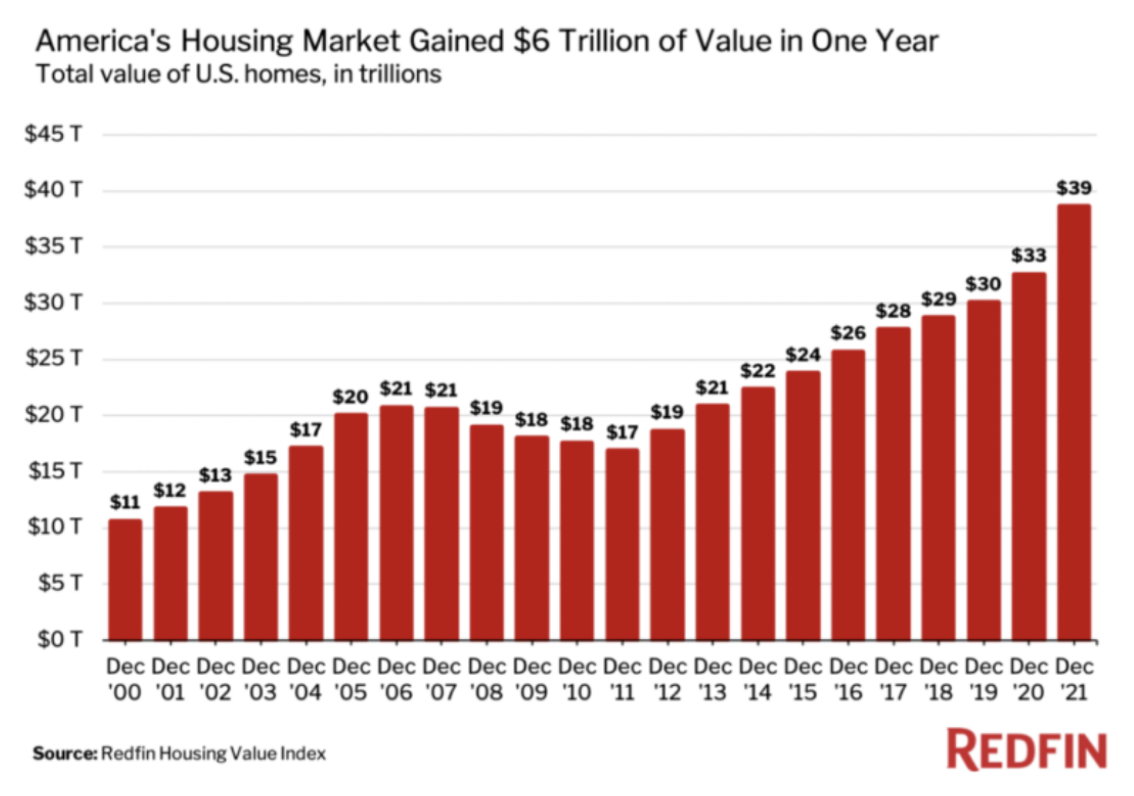

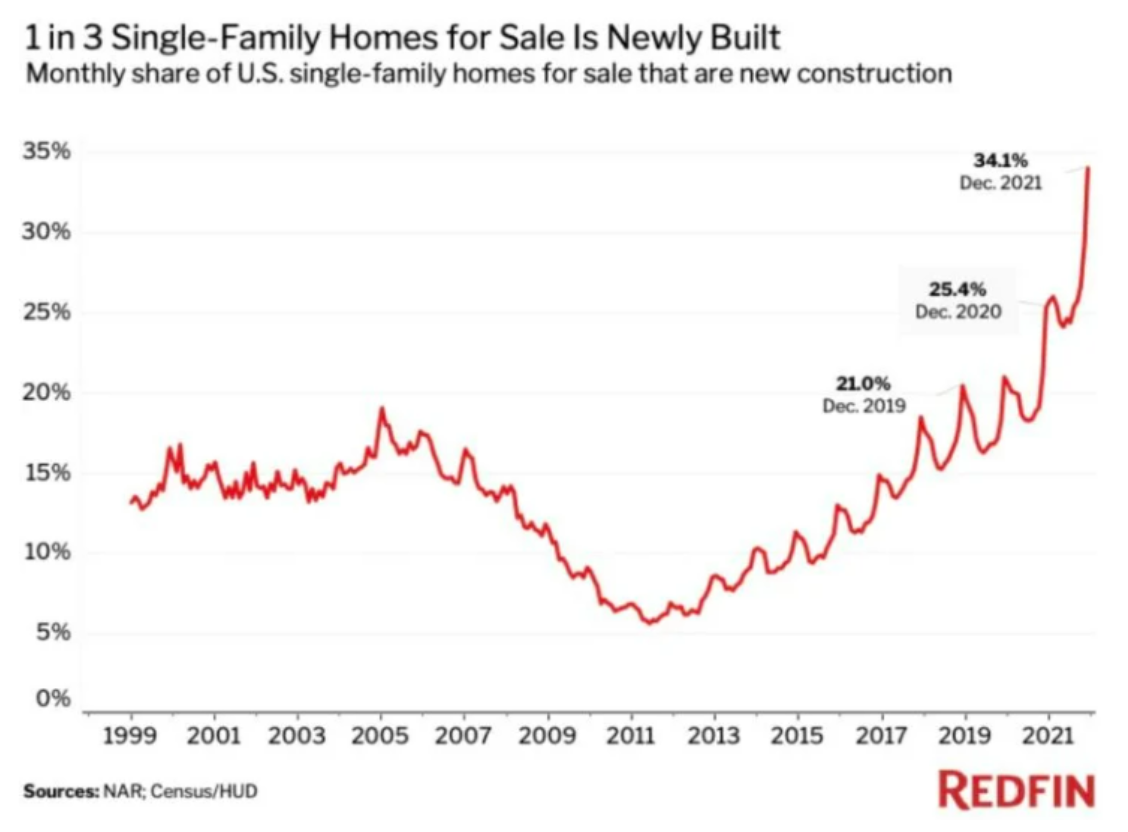

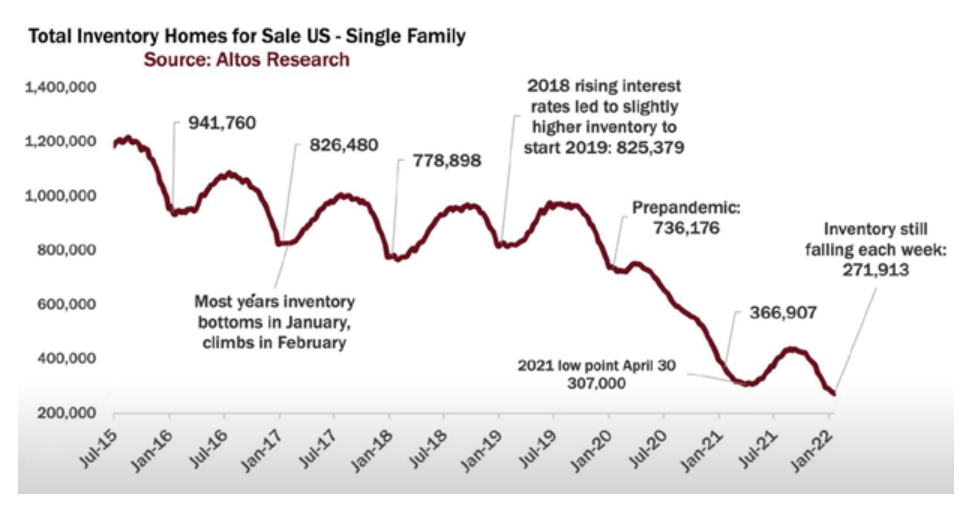

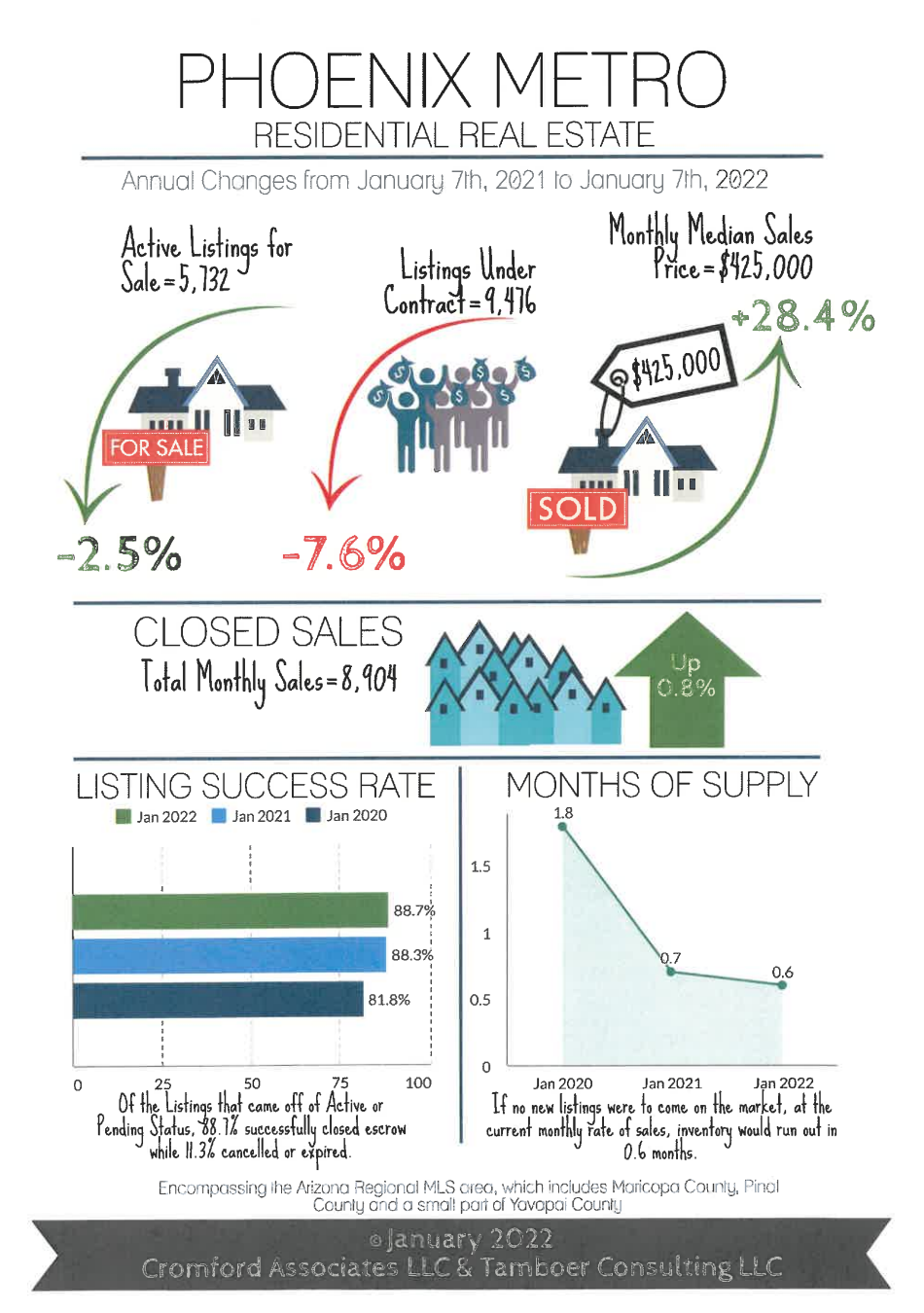

“What we do know, we begin 2022 with the lowest number of active listings at year’s end on record. And, while we all know the 28% year-over-year increase in the median sales price last year is unsustainable, there is nothing holding back continued price gains in the short term. We know a change is coming, but there are two questions I can’t answer: When will our market moderate? Where will the increase in supply come from? We do know, it isn’t going to moderate tomorrow. New construction and distressed sales will not increase our supply as new construction did in 2004 and 2005, and distressed properties did in 2009, 2010 and 2011.”

For Buyers:

With the rising cost of home prices in Greater Phoenix, the question of whether or not to rent or buy become harder to answer for some buyers. The financial advantage of owning versus renting is usually realized for those who own their home for at least 3-5 years. 42% of homeowners with a loan are equity rich, meaning their home’s value is at least double the loan amount. Arizona is among the top three states.

Phoenix ranks number five in top investment markets due to the job growth and household formation rates.

For Sellers:

Greater Phoenix has moved farther into a seller’s market over the past month. 2022 started off with another historically low supply level, and listings under contract, while 7.6% below 2021, still strong with the 2nd highest count since 2014.

Since 2014, buyers buying their primary residence have made up 70%-76% of total residence purchases in Maricopa and Pinal County. In Q2 2021, that percentage dipped to 67%, and declined to 63% by October. We then saw many traditional buyers retreat and second home buyers and institutional buyers (iBuyers, hedge funds and other investment groups) step in. Price appreciation slowed from an average of 3.3% per month to 1.1%.

Spring is typically the strongest season for buyers.